Award-winning PDF software

Form 3949-A Arizona: What You Should Know

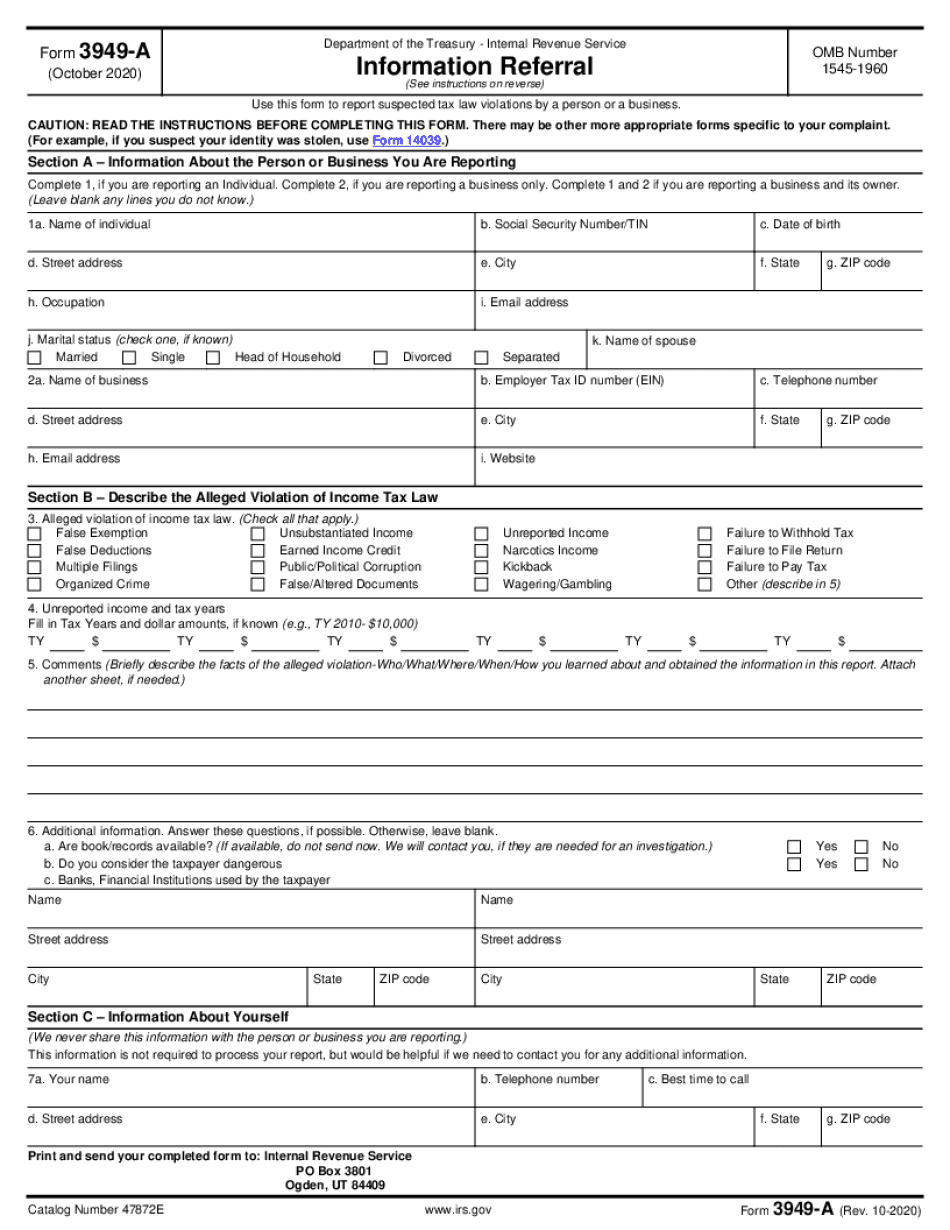

Form 3949 or Form 14039 and any other appropriate document must be sent to: Criminal Investigations Unit Phoenix, Arizona 85 Arizona Department of Revenue | PO Box 29099 Phoenix, AZ 85 Telephone:, Option 2;, Option 1 Callers are encouraged to keep all electronic documents, e-mail, and receipts. Note: Tax fraud is a serious offense. Should you be the victim of a crime and the offender should not be found, you are entitled to be reimbursed for the amount of your tax withheld. You may be eligible to receive the full amount of your tax withheld if you file a federal tax return, unless the crime was committed using your Social Security number and your taxpayer ID#. How do I report suspected tax law violations regarding property taxes? Property Tax Fraud — Arizona Department of Revenue You can report suspected tax law violations regarding property taxes using the Tax Fraud Tip Form. A. (2-2008). Arizona Revenue Department. Property Tax Assistance Program. Property Tax Fraud Tips — TTF Form 3949-B. Arizona Department of Revenue. P.O. Box 3008, Phoenix, AZ 85. Note: It should be noted that this Form 3949-B only is used if you suspect the property owned by a taxpayer was: (1) fraudulently obtained; (2) unlawfully sold, transferred, used, or otherwise disposed of; or (3) taken by fraud against the IRS or the state of Arizona. Other forms and procedures may help to prevent or lessen the possibility of property tax fraud within the State of Arizona. Be sure to check with your local law enforcement, government agencies, and other entities regarding any problems you encounter regarding property taxes. How do I report tax law violations via the U.S. Postal Service? Under the Internal Revenue Code of 1986, a federal agent must collect the proper documentation to issue a notice of lien upon property for unpaid taxes that do not have a valid payment method or to file a claim for refund. The purpose of these requirements is to collect the unpaid tax, which is owed by the taxpayer, for the purposes of determining whether to levy a lien upon any property belonging to or in payment of the taxpayer for tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 3949-A Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form 3949-A Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 3949-A Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 3949-A Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.