Award-winning PDF software

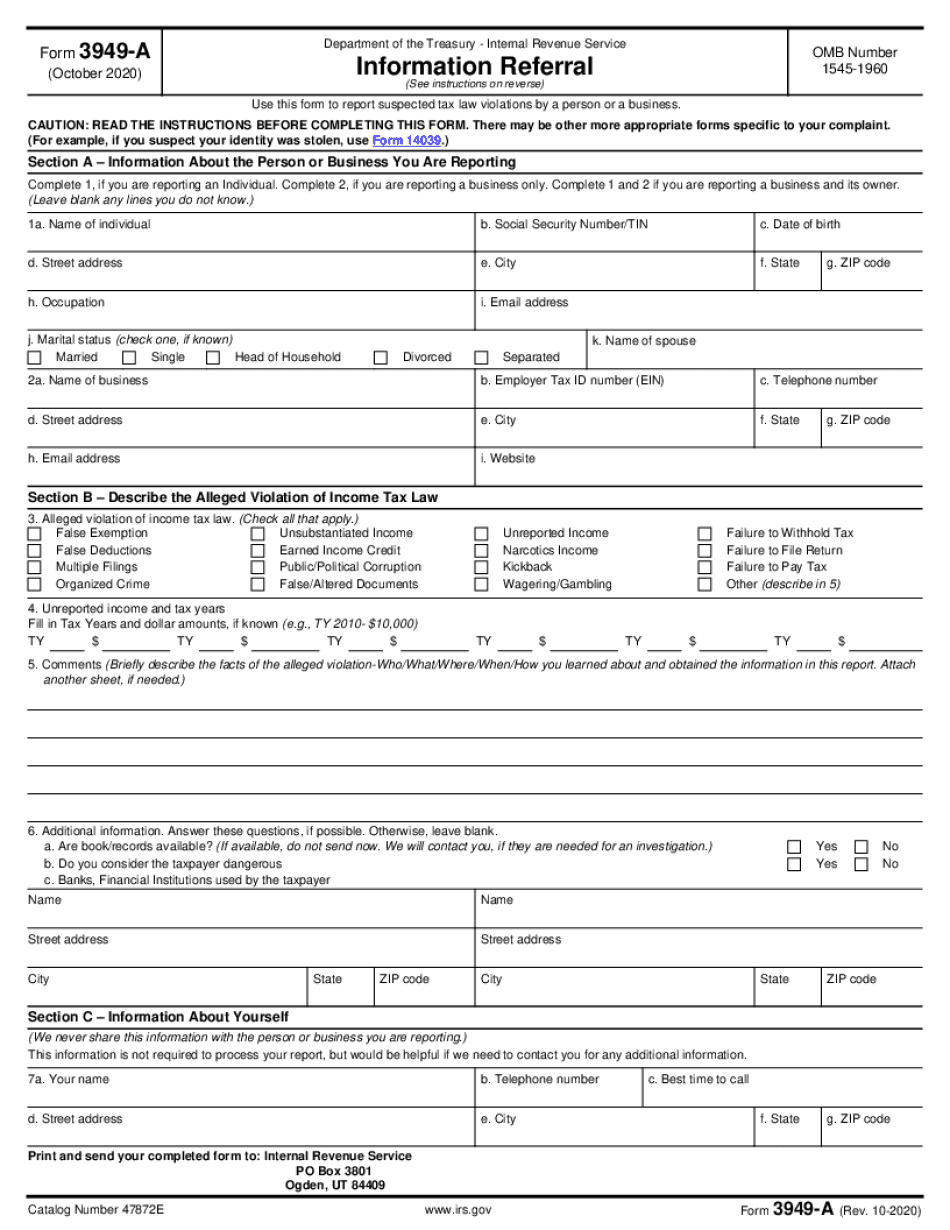

Wayne Michigan Form 3949-A: What You Should Know

A federal summons for a failure to file a Form 540 Tax Return. • The Internal Revenue Service has opened a case against the taxpayer for failure to file a Form 540 Tax Return. This information is available for the state of Maryland only. The Form 540 is due to be received by February 10. The taxpayer can view the summons by clicking the following link. It may be helpful to file a paper application for the summons and the attachment. Form 730 — New Mexico Individual Income Tax Submit Form 14039 Identity Theft. Affidavit to the IRS. • Contact the New Mexico Department of Taxation's Identity Theft Information line at. How many times have you been told your tax return has been delayed for filing a wrong form or that you lost a paper? Most of us are familiar with these types of frustrating situations, but there are a few situations that sometimes make our tax returns even more difficult to fill. If you are the victim of identity theft, some of these questions may be helpful to you. You may be tempted to file a claim against the victim of the identity theft for reimbursement of expenses that the victim experienced. You may have to ask the victim if that is true. Furthermore, you will need to understand the procedures which will be used for the claim and to know what the victim can do for you. The victim should be asked about any losses and if necessary the victim should be told how much he or she paid or the amount of services he or she rendered. The victim should be asked to be an “appraiser” of his or her own circumstances and then be given a copy of the form. Many victims will not want to submit information because they are angry or humiliated. They are less likely to be willing to provide information that would require them to go through the process of litigation. The purpose of filing a claim against the victim of identity theft is to provide the victim with his or her own financial information and with support for the restitution or compensatory damages owed by the victim of the theft. If the victim has already filed a claim for reimbursement of expenditures, it does not matter who files a claim against them. If the victim was not the victim of the attempted or actual theft, if there were problems with the application or the application was lost while being processed and the victim did not give permission for information to be used for the claim, the perpetrator may be the one to file a claim against the victim. The process is complex and involves many steps. The process begins immediately.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Wayne Michigan Form 3949-A, keep away from glitches and furnish it inside a timely method:

How to complete a Wayne Michigan Form 3949-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Wayne Michigan Form 3949-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Wayne Michigan Form 3949-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.