Award-winning PDF software

Printable Form 3949-A Fulton Georgia: What You Should Know

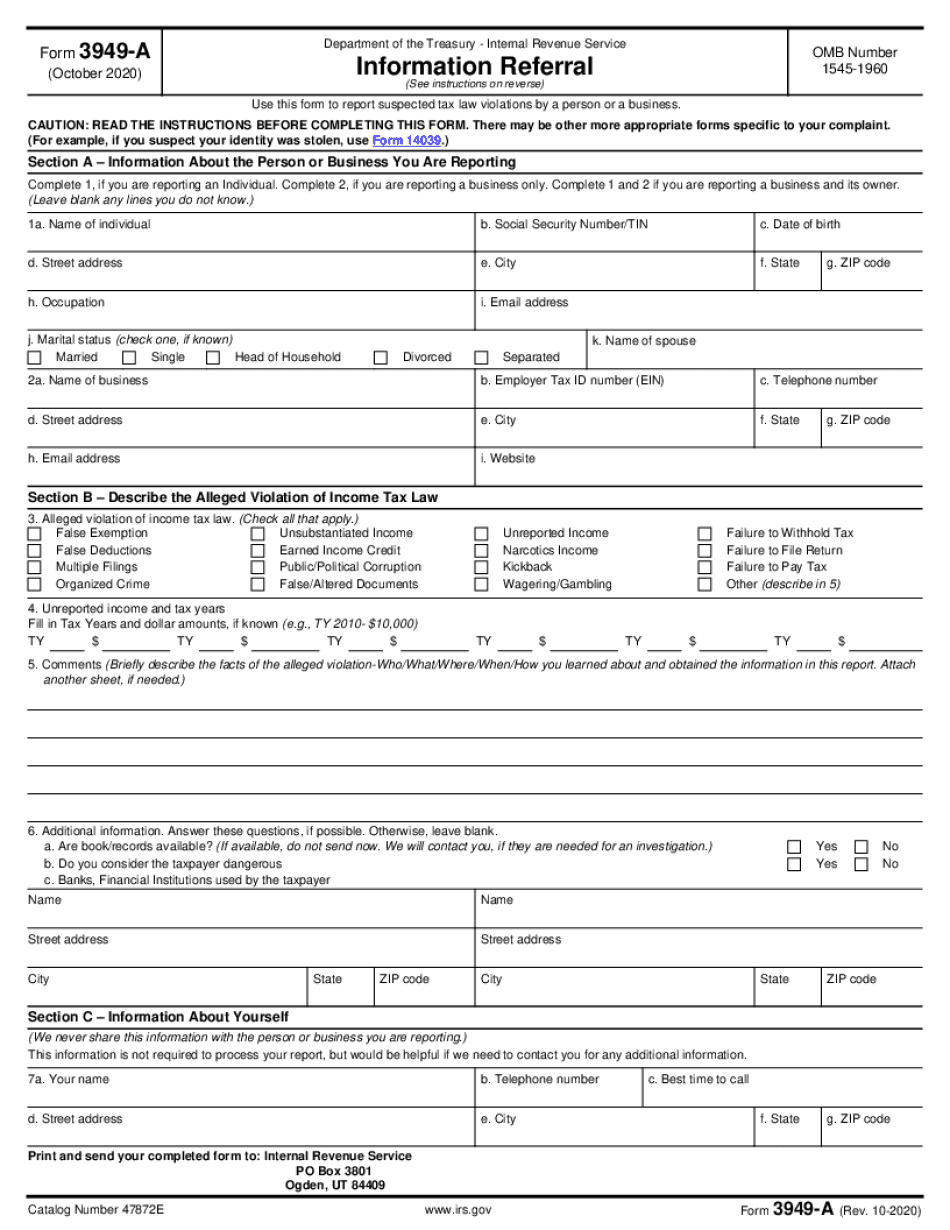

The Form 3949-A is part of the Treasury OIT/IAT/FATF program, which is designed to identify taxpayers whose financial transactions may be fraudulent. The Treasury OIT has no jurisdiction over individual income tax return procedures and has no direct link to law enforcement. If you see something that doesn't look right on your tax returns, and you don't think it's tax fraud, contact the IRS and report it as soon as possible. Do not wait until you've filed to report suspicious transactions! Contact the IRS with copies of tax returns and other documents, so that a determination can be made what tax information might need to be reported and documented in your returns. IRS will take steps to help investigate tax fraud immediately. The U.S. General Accounting Office (GAO) conducts an annual review of financial integrity of the federal agencies involved in tax administration. The GAO reports annually on IRS programs; is a strong advocate for financial audits and collections programs of the IRS; advises Congress and the president on tax policy; and works with various private sector and government stakeholders to address issues affecting IRS tax collections and enforcement. Forms, Instructions, and Resources Use this PDF to fill out Form 3949-A (3-2016). Use this PDF to fill out Form 3949 to Report a Person or Business that has Not Received Proper Notification (2-2007). Use this PDF to report suspicious activity (3-2017). Use this PDF to report suspected violation of tax laws (2016); Form 5921 (3-2016). Information Referral — Internal Revenue Service The purpose of this form is to assist taxpayers in identifying the type of business that might be violating the Internal Revenue Code. The form provides the name and mailing address of the reporting taxpayer as well as a telephone number and the location the IRS can be reached at during regular business hours. The taxpayer has six (6) calendar days from the date the taxpayer receives correspondence to submit the form. Please ensure that the Form 3949 is received in full. Form 3949 can also be used when the taxpayer does not feel comfortable sending a copy to IRS. If you're unsure of when you must submit an electronic Form 3949, consult with your tax advisor to determine a more appropriate time limit. The filing deadline is March 31st for tax reporting purposes. Please file an electronic Form 3949 at least 24 hours before the due date; please do not submit your Form 3949 until you have received payment.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 3949-A Fulton Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 3949-A Fulton Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 3949-A Fulton Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 3949-A Fulton Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.