Award-winning PDF software

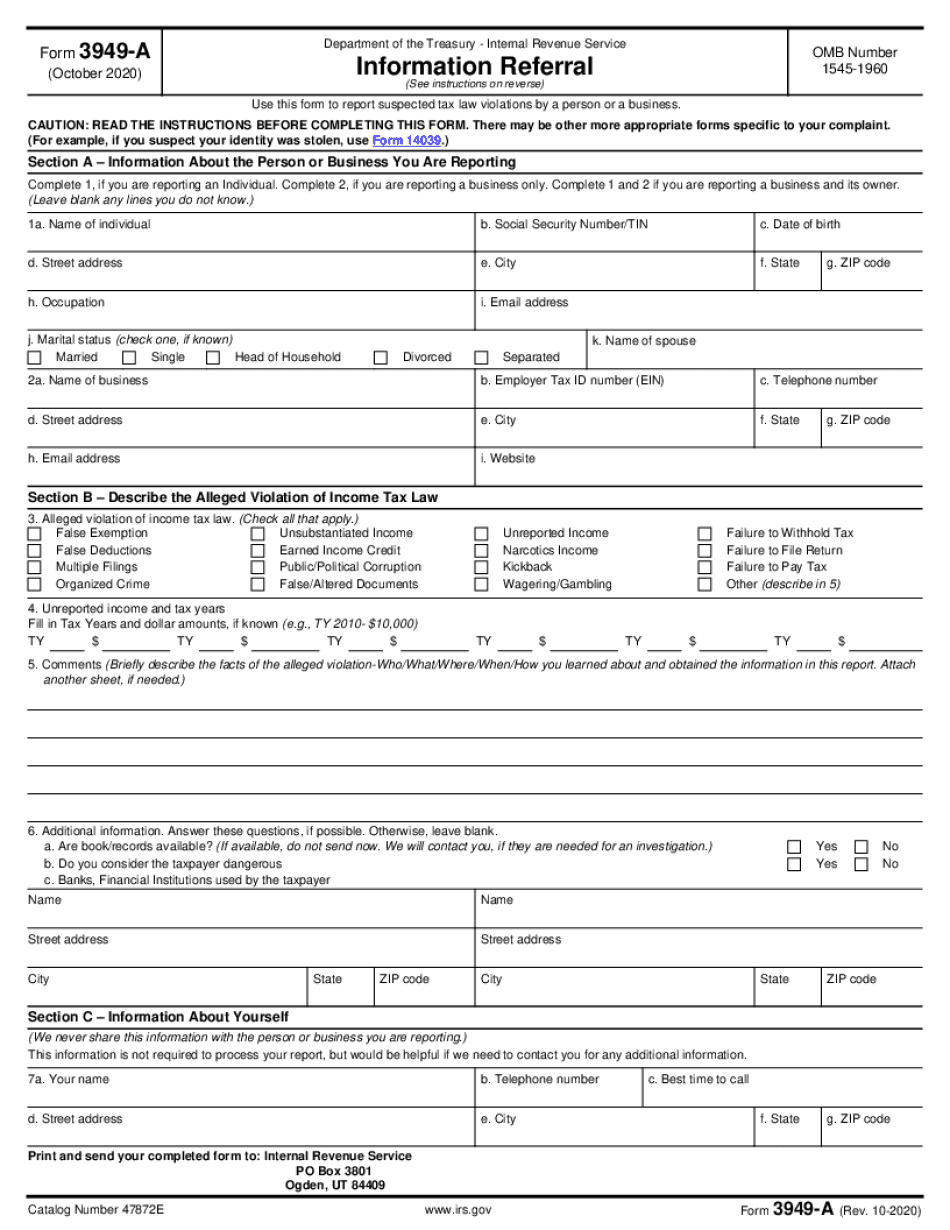

Kings New York online Form 3949-A: What You Should Know

FREE. Do you have to wait 2-3 months for your refund from fraudulently reported Social Security Number or SSN? What if the IRS returns your refund to you without your return? You've come to the right place… We've put a lot of work into this website, we hope you find it useful and have fun learning about identity theft, SSNs and SSAS. It's a simple matter of filling out a short form, and your return will be mailed to you within 2 weeks. If a Form 14039 is required in your county it may be easier and faster to fill it out online right from the IRS website than try to get it for you from the IRS. The IRS will send you a notification of the IRS request. How many people have had fraudulent Social Security numbers or SSNs stolen? It depends on how long the crime is ongoing, where/how often it involves multiple victims and the type of fraud. A criminal may have stolen your Social Security number or SSN and you may not know it — or not even know who has your information. A government agency (the IRS) may have stolen your identity. It's not known how many individuals have been victimized by identity thieves who used their legitimate identity. According to the FBI, Social Security numbers are the most common source of fraud, or more than 80% of all personal identity thieves use their SSN. While most personal identity theft consists of theft of information such as names, addresses, Social Security numbers, and birthdates, some identity theft offenders use passwords or other valuable forms of information to obtain other personal information, such as bank account numbers and credit card numbers. In the late 1990s, the IRS began tracking the extent of identity theft incidents, as a result of a report in the New York Times. Between 1998 and 2003, the IRS reported more than 14,000 identity theft incidents. The most common method for fraudulently obtaining a number is to contact the individual who is applying to obtain a number. In recent years, thieves have begun using cell phones, the Internet, online directories, and phone calls to commit identity theft. One common fraud strategy is to ask the victim for personal information such as a phone number or e-mail address, and to then use the personal information in order to obtain a number. Often, the thief will ask only for a name, and will use the stolen personal information to receive an SSN.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Kings New York online Form 3949-A, keep away from glitches and furnish it inside a timely method:

How to complete a Kings New York online Form 3949-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Kings New York online Form 3949-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Kings New York online Form 3949-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.