Award-winning PDF software

Form 3949-A online Riverside California: What You Should Know

Taxpayer's Power of Attorney The Federal Taxation Form 2848 is a legal document which can be used to represent the taxpayer in many situations. When you need help with the tax affairs in your life, you should take this latest version of the document. For further information contact your personal law practice: Or write or call: The Palm Beach County CPA Society 7205 E. Tamiami Trail West Palm Beach, FL 33 Email: infopbcsociety.com You need no additional fee to file the form. It is a free electronic document for the taxpayer to use to write, telephone, file taxes electronically and sign. If anyone is confused you may like to read this : Form 2848 — Power of Attorney for Tax Matters The current version of Form 2848 is only designed for tax purposes and not for other situations where you would want your agent to have the power of attorney in place. This document is for the taxpayer. It is an authorization to use a practitioner in the tax area. It is not the Power of Attorney if you are seeking help in other areas. Form 2848 does not make the taxpayer the practitioner. The taxpayer is the person authorized to carry out the work. If you receive a request from a practitioner to sign a Form 2848 as a practitioner then you should review the instructions and make sure you understand what these are. You may need to ask for a review with your personal tax attorney. Form 2848 is an instrument and not a contract. You should never agree to terms of service with a Form 2848. A person representing a particular person or business does not need to use the same power of attorney or the same representative for all situations. In some situations one person might be the representative and in other situations a different person would be the representative. Form 2848 is only for tax and not for other situations. When you take effect, the document becomes part of the tax return and must be maintained, unless you amend it to remove an unauthorized signature. Your personal tax attorney will need to review the document and decide if it would be best if the signature was not on it. Form 2848 can be executed as an actual power of attorney or can be signed as a document which authorizes another person, but does not create a power of attorney. Form 2848 can be for one or for more than one person.

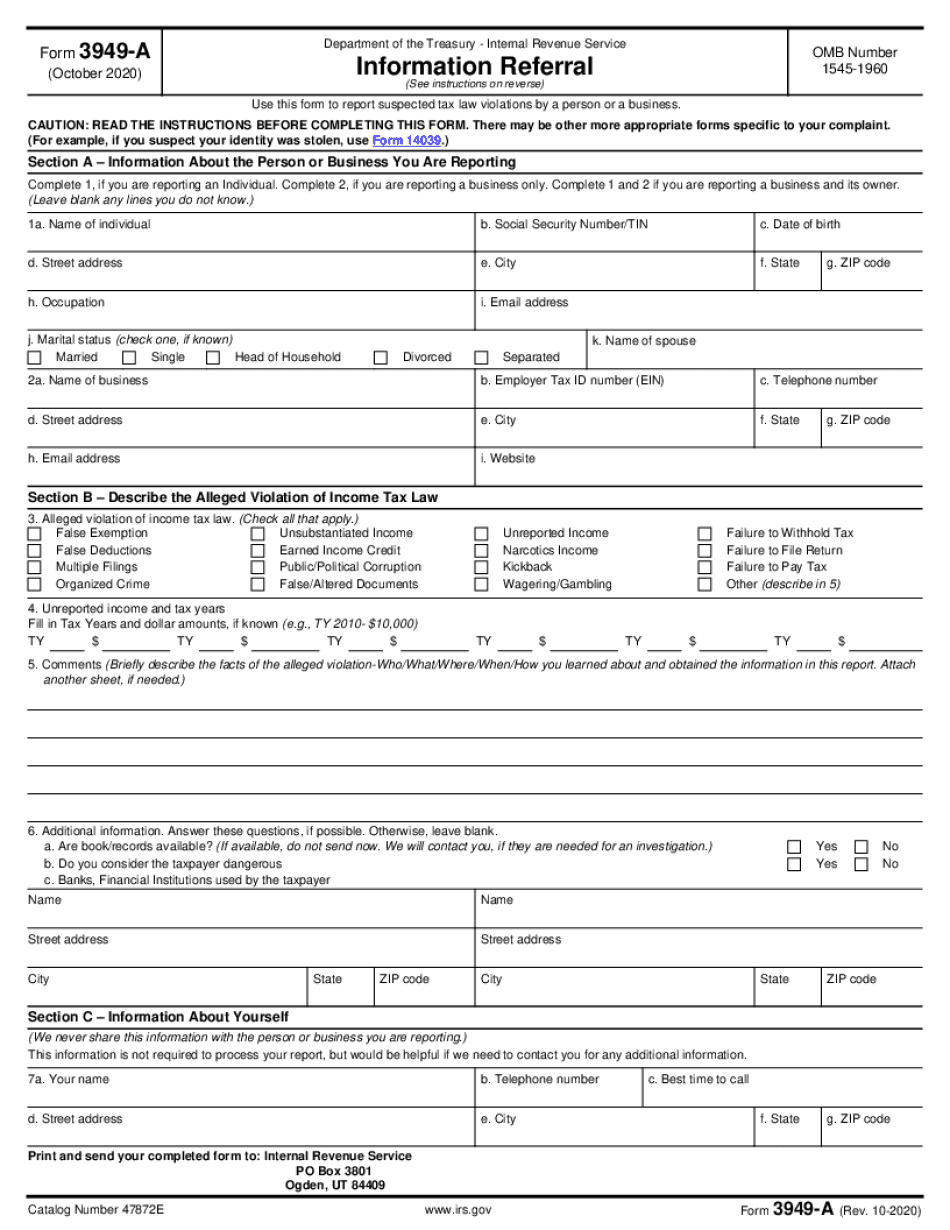

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 3949-A online Riverside California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 3949-A online Riverside California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 3949-A online Riverside California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 3949-A online Riverside California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.