Award-winning PDF software

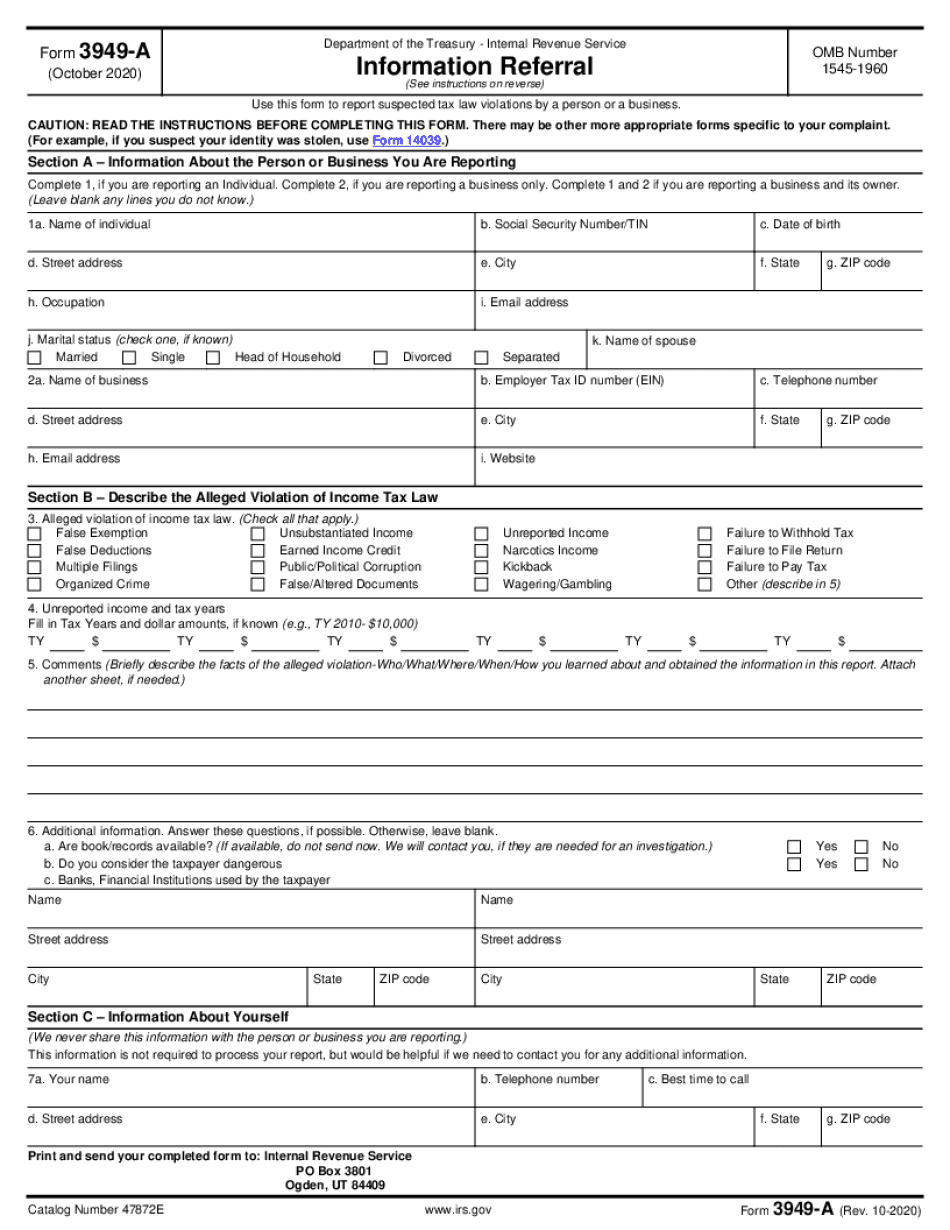

Printable Form 3949-A Pembroke Pines Florida: What You Should Know

Learn About How Do I Report Tax Law Violations? Fill out both your Federal and State Tax returns. Use your own words and make it clear you are notifying the IRS of the problem. Send both to the IRS at the following address. Report the tax law issue, if you can, but don't expect the agency to do anything about it. There are no penalties for not complying with Form 3949-A if you're filing your taxes electronically. However, you could encounter other problems like being denied or delaying your refund. To learn what may happen, see a tax professional. Do not assume that a Form 3949-A or any other paper return is proof you didn't make a mistake when filing. You will still be responsible for getting paid and will still have to pay the applicable tax. Form 3949-A is a report. It isn't a tax audit, penalty waiver, or a request for an extension of time to file. Even though tax law violations are reported on your tax returns, it is possible your return was not filed properly, possibly because of error. It is good to make sure your tax return is correct and that all items are correctly marked. Be prepared for any IRS audit in the future. Find an Attorney If Your Problems Are Legal. Even though you're required to file a paper return, you can choose to write your problems on a Form 3949-A online or send a letter with your problem to the IRS. This may help avoid any further legal issues, and it may help prevent the IRS from pursuing punitive damages. If you decide to use Form 3949-A online, you must select File Online. Otherwise, you must select Send Form 3949-A. Also, make your Form 3949-A and all attachments one piece and keep copies of each of these for your records. Make sure you know who you should report your matter to if you choose to use Form 3949-A online. See IRS.gov for the specific instructions on creating this form. IRS.gov — Forms and Publications You Should Know for 2025 Tax Year Find the latest publication, 2025 Federal Income Tax Toolkit, and view all current publications. How Do I Report Tax Law Violations? Download the PDF Form 3949-A for exactly your city and then fill out both the federal and state tax returns. If you're filing electronically, you must have both your return and the form. Send it to the IRS at the following address.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 3949-A Pembroke Pines Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 3949-A Pembroke Pines Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 3949-A Pembroke Pines Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 3949-A Pembroke Pines Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.