Award-winning PDF software

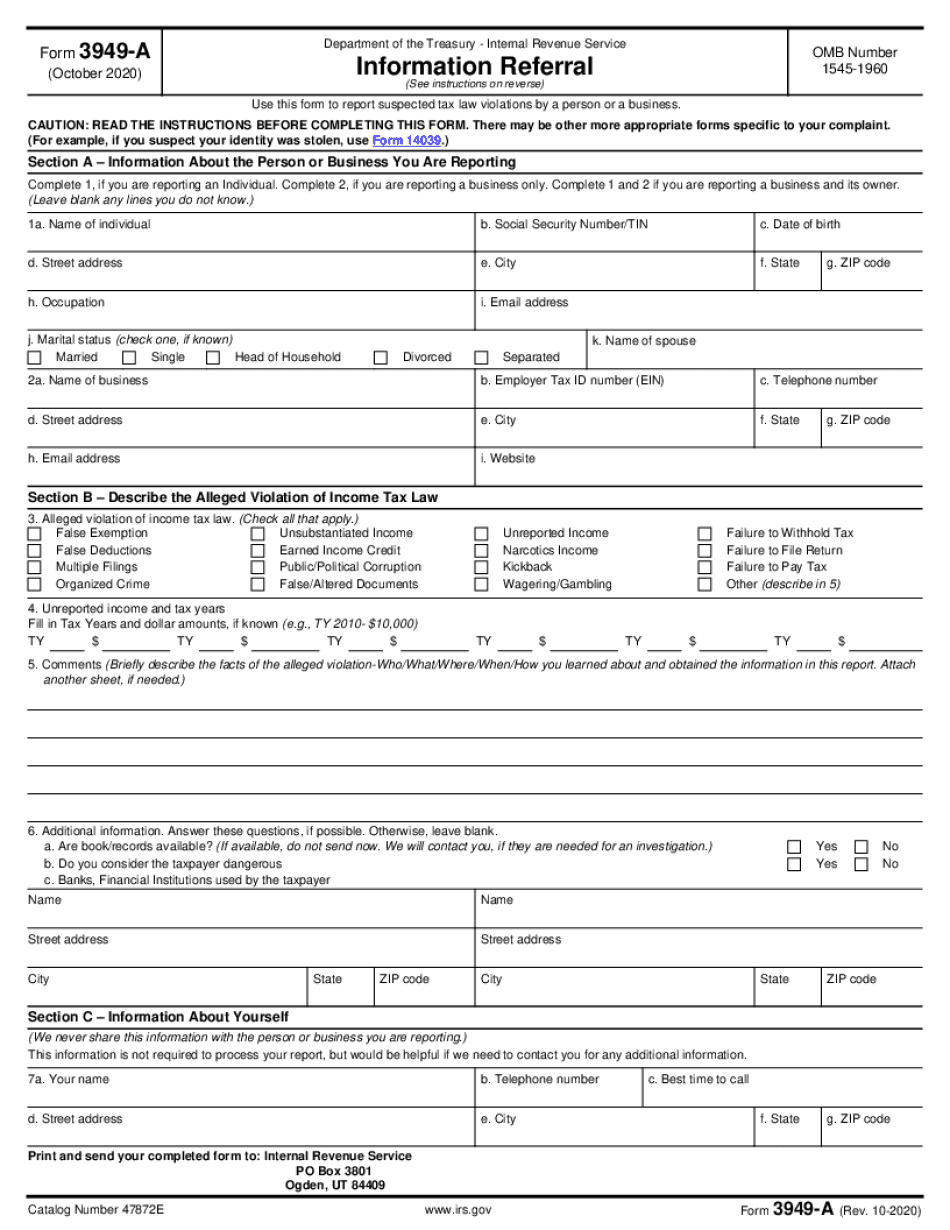

Form 3949-A online Fayetteville North Carolina: What You Should Know

Instructions for Form D-3949A, Tax Fraud and Identity Theft. If the IRS or a court orders the IRS to turn over any of your records, you must immediately turn them all over. Your account information could be used to commit tax fraud. Form 706, Affidavits of Support — IRS Inspector General's Information Return Instructions for Form 706, “Information Return Related to Tax-Related Persons.” IRS Form W-9 and IRS Form W-8G — Employment Taxes Instructions for Form W-9 and Form W-8G, Form W-9 for Individuals and Form W-8G for Corporations. Use a bank statement from your previous employer. If you have a W-2, Form W-9 must be filed on Form W-2. Employer Identification Number, EIN, or Social Security number. The Social Security number must be on the original W-2. If you have an employer-issued pay stub, you should provide the W-2 number to obtain a W-9. However, a W-9 must be filed if you are filing with a Form W-10 or a Form W-2T. Payroll deductions, like those made at work for housing expenses, may be considered income when you make an estimated tax payment. If you have an income tax return with a return to present, pay the estimated tax. If you don't do this, your taxes will be delayed, and you'll have to pay more taxes in addition to filing an amended return. If your company pays a dividend each year, the corporation pays income tax on the dividend income. The dividends may be included on the recipient's Form 1120, 1040, 1040A, 1040EZ or 1040NR. There are three ways to report the dividends. Dividends reported through Form 1099 or similar paper form or through Form 2555, Investment Income or Loss. Dividends reported through Form 1099 or other document. The 1099/1099-MISC should be filed using Form 1095-B or Form 5498. Income tax should be paid under an IRC Section 7422. In most cases, any additional taxes reported on an S-Corporation return should be paid under IRC Section 1348.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 3949-A online Fayetteville North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 3949-A online Fayetteville North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 3949-A online Fayetteville North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 3949-A online Fayetteville North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.