Award-winning PDF software

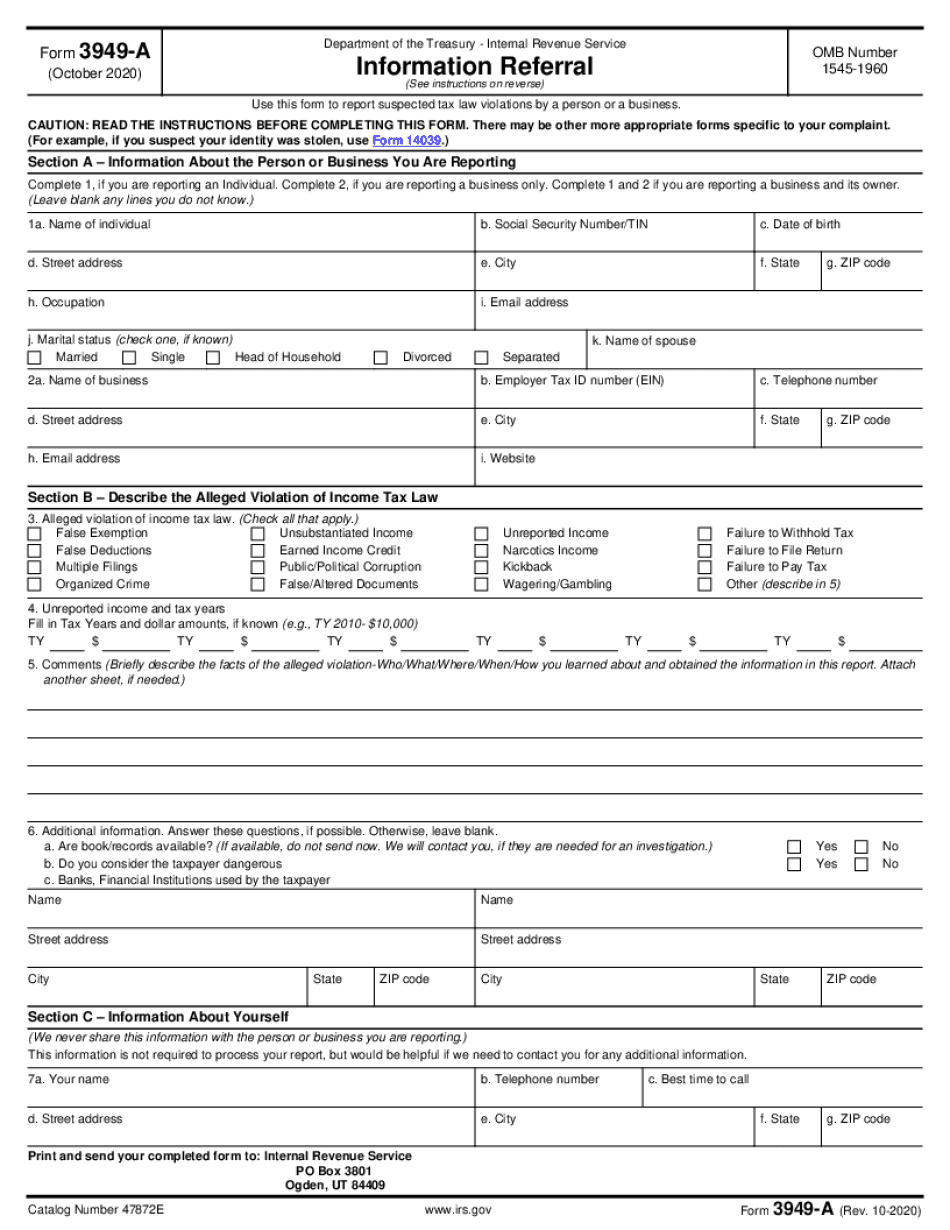

Form 3949-A online Bellevue Washington: What You Should Know

With the IRS filing the Form 843 and the F-1 or J Form 843: Report of Income from Reimbursed Federal Income Taxes Taxpayers have two options for filing Form 843, including the use of a paper form to complete (with their own name on the cover sheet). The student or scholar must also include a statement with Section A with the filing. The student must also provide a signed declaration indicating that all tax information was correct. Form 843 has a line for the employer and has a line for the student. The form has a line for the employer asking the employer to pay the student a penalty waiver of the employer filing and Line 1: Penalty Abatement Request and Line 2: Reasonable Cause. All penalties, interest, fee, and additions to tax should be reported. If the Form 843 was submitted for the refund of taxes assessed, but the student has no tax liability, then no penalty should be reported. If a refund is received or if a penalty is paid, a statement should be submitted indicating that the refund was due and the amount, including the tax penalty. For more information on filing and completing a Form 843, see Tax FAQs for F-1s. If the Form 843 was submitted for the abatement of an underpayment of taxes, or for the refund of an overpayment of taxes, then it appears that the tax is assessed on Form 1065 — Additional Tax on Overpayments: For Further Information See page 1061. Form 843 may not be used to correct overpayments of tax not due to be refunded or to request an adjustment of tax. For more information on calculating your tax liability see the IRS Publication 450, Estimated Tax. For more information on how to file this form for the penalty abatement and refund, see Form 840, Request for A Refund of Tax, and Form 840-SA, Request for Waiver of Overpayment of Tax, in Tax Filing Requirements for the Information Technicians Class Guide (ITC-K-9). For further guidance regarding abatement of tax, see the tax article Refund of Penalty Abatement for Abatement of Underpayments of Taxes (Including the Refund of Additional Tax) in Publication 550, Other Individual Income Tax. Tax FAQs for F-1/J- (3) Filing and completing the form for the assessment of U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 3949-A online Bellevue Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 3949-A online Bellevue Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 3949-A online Bellevue Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 3949-A online Bellevue Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.