Award-winning PDF software

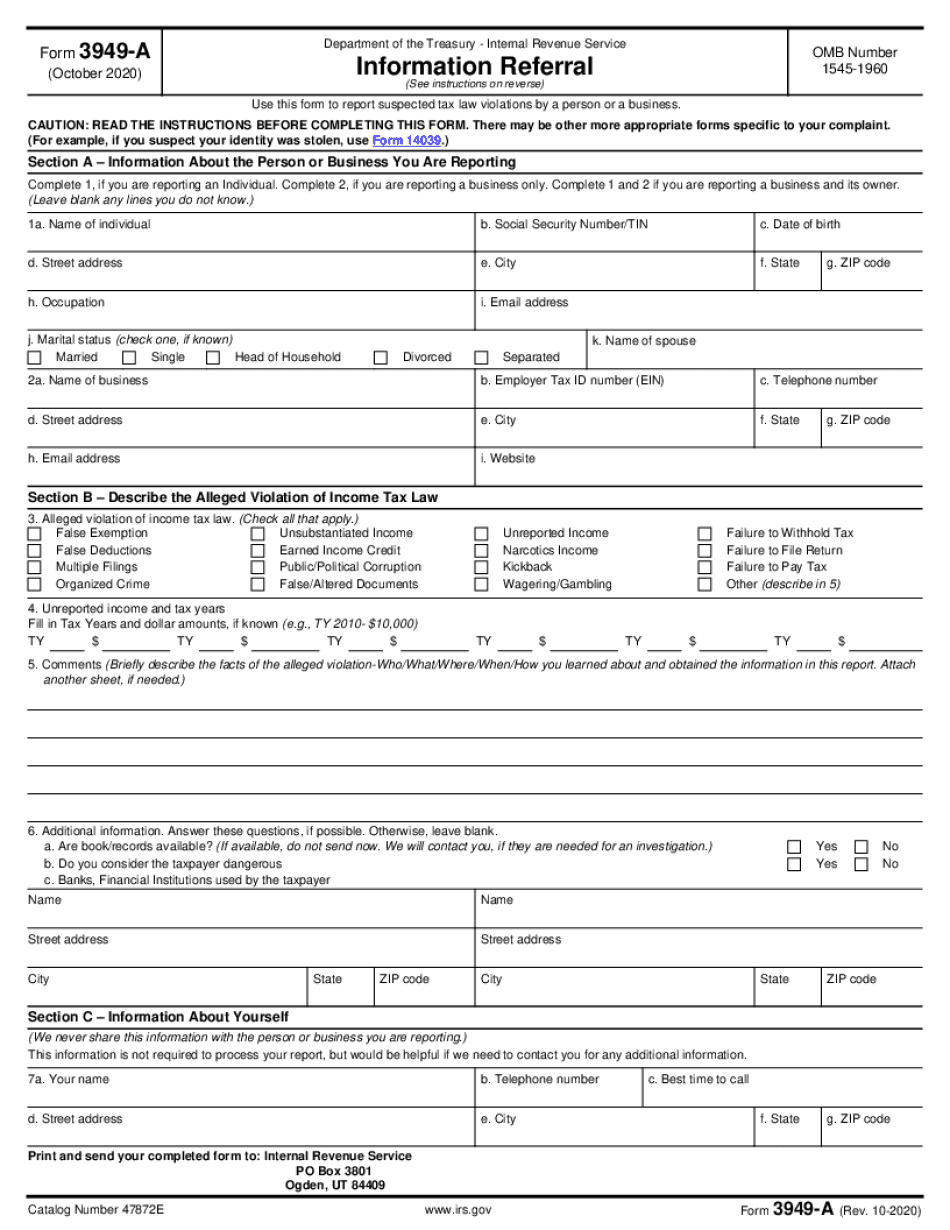

Form 3949-A for Waterbury Connecticut: What You Should Know

Connecticut Resident Income Tax — CT.gov Mar 21, 2025 — Connecticut resident may not make an election on Form 4401-G to claim the Connecticut credit during this tax year. Connecticut Resident Income Tax — CT.gov Nov 7, 2025 — Residents of the state of Connecticut may make a qualifying joint return without filing Form 2686 or Connecticut Resident Income Tax — CT.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 3949-A for Waterbury Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form 3949-A for Waterbury Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 3949-A for Waterbury Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 3949-A for Waterbury Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.