Award-winning PDF software

Irs 3949-a meme Form: What You Should Know

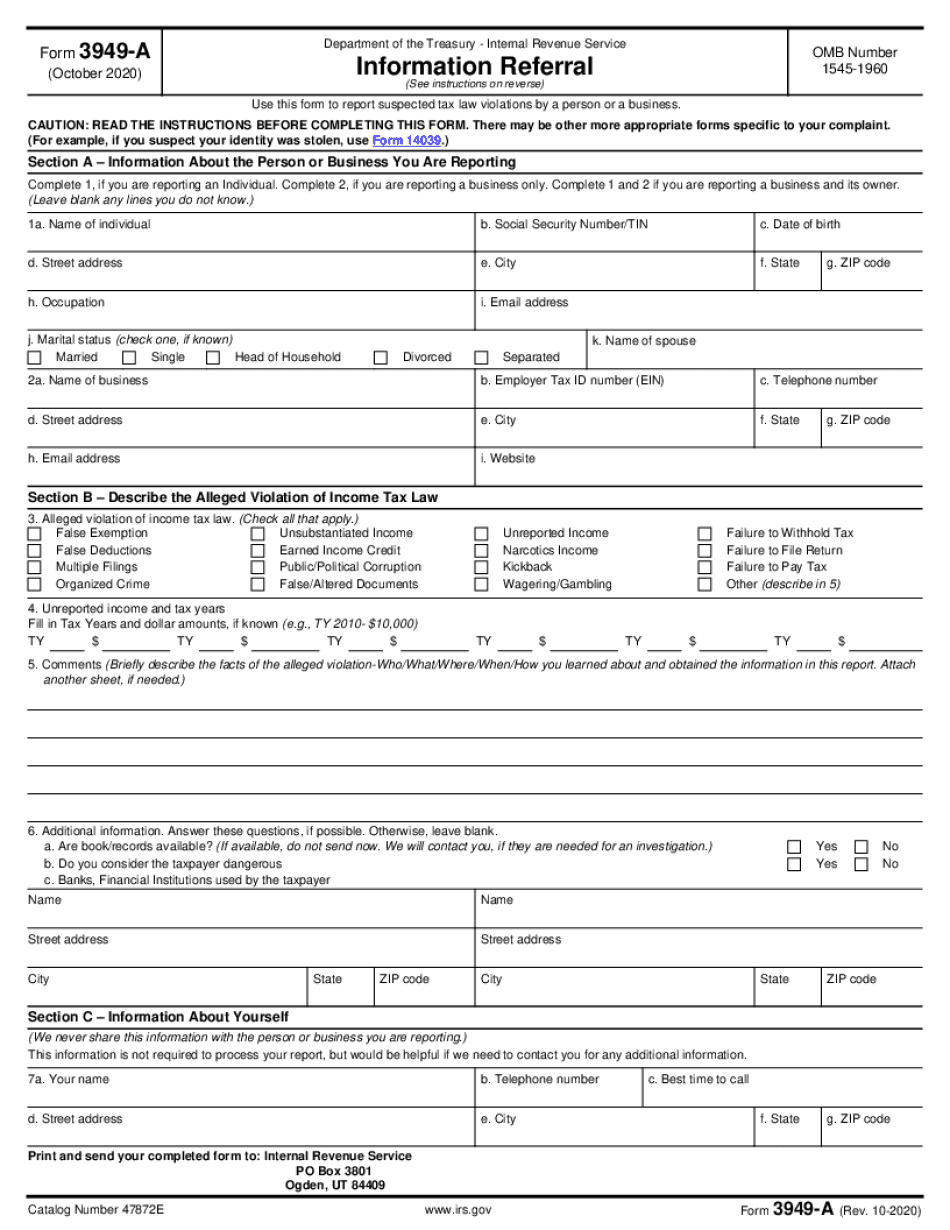

The Form 3949-A does not trigger an audit. It is available to any person or business. It does not provide guidance on tax laws. Please read the “Frequently Asked Questions and Explanations on Form 3949-A”. If there is a question on a particular tax law, please contact the appropriate information office nearest you. 3.28.2.A Form 3949-A forms are issued only by the IRS. The IRS has no obligation to process a request. The form cannot be issued until a requestor submits it with all required information. 3.28.2. B The IRS does not verify the authenticity or accuracy of information submitted by customers on the form. The information in the Form 3949-A provided is considered confidential and exempt from disclosure under the Federal Lobbying Disclosure Act. A requestor may be subject to criminal and civil penalties as a result of noncompliance with a request or failure to comply with a requirement. All responses to the form are final and are not open to reexamination. 4. Acknowledgments and Agreements of Waiver or Release of Liability All forms, forms sections and sections of forms referenced are hereby marked as being subject to the following Awareness, Release and Waiver of Liability provisions as follows: 4.1. This is a final notice. 4.2 The IRS will notify the requester that the IRS may, from time to time, require the requester to submit additional information or change requests. 4.3 When a customer provides complete information on any of the applicable forms to the IRS, the IRS will notify all requesters. 4.4 Unless the Customer expressly waives his or her rights in this notice to the contrary, neither the IRS nor any of its representatives will have the power of any kind to require that a Form 3949 be submitted or that a requester comply with any terms of this notice. 4.5 If the Tax Law Service requires a customer to submit a Form 3949 to determine if a tax assessment should be made on an account, the IRS will forward that Form 3949 to the taxpayer's accountant. 5.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 3949-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 3949-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 3949-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 3949-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.